Why We’re Building Aeris Evolution

In early 2023, Martin and I, sobered by what we saw in industry data, decided to leave our careers at Airbus and Boeing.

It simply costs too much to develop new commercial aircraft.*

Any aircraft manufacturer that failed to recognize this would either get disrupted, or risk bankruptcy. The more we ran the numbers, the more those numbers showed that the technology was ready for vastly more accessible and sustainable aviation, but the economics to get there were not.

We became convinced that the future of commercial aviation will be defined by:

fully modular aircraft that evolve in-service as technology matures;

how we build aircraft just as much as what aircraft we build;

seizing a once-in-a-generation opportunity to disrupt newly vulnerable incumbents.

No one else was building this future.

So we launched Aeris Evolution.

Because flying should feel like the future – not the past.

The Economics of Aircraft Development

Aircraft development is one of the most complex industrial challenges. Hundreds of thousands of parts are meticulously designed and certified, not only to ensure that the aircraft will function properly, but also that the production process flawlessly replicates the design. Safety is sacrosanct.

The OEM (Original Equipment Manufacturer, e.g., Boeing, Airbus, Embraer) must invest a tremendous amount of upfront capital. Boeing estimates that their next new aircraft, a replacement for the 737, will require ~$30B before first delivery, and then at least another 7-8 years of steady production before the program recoups those costs.

It’s a massive amount of financial risk.

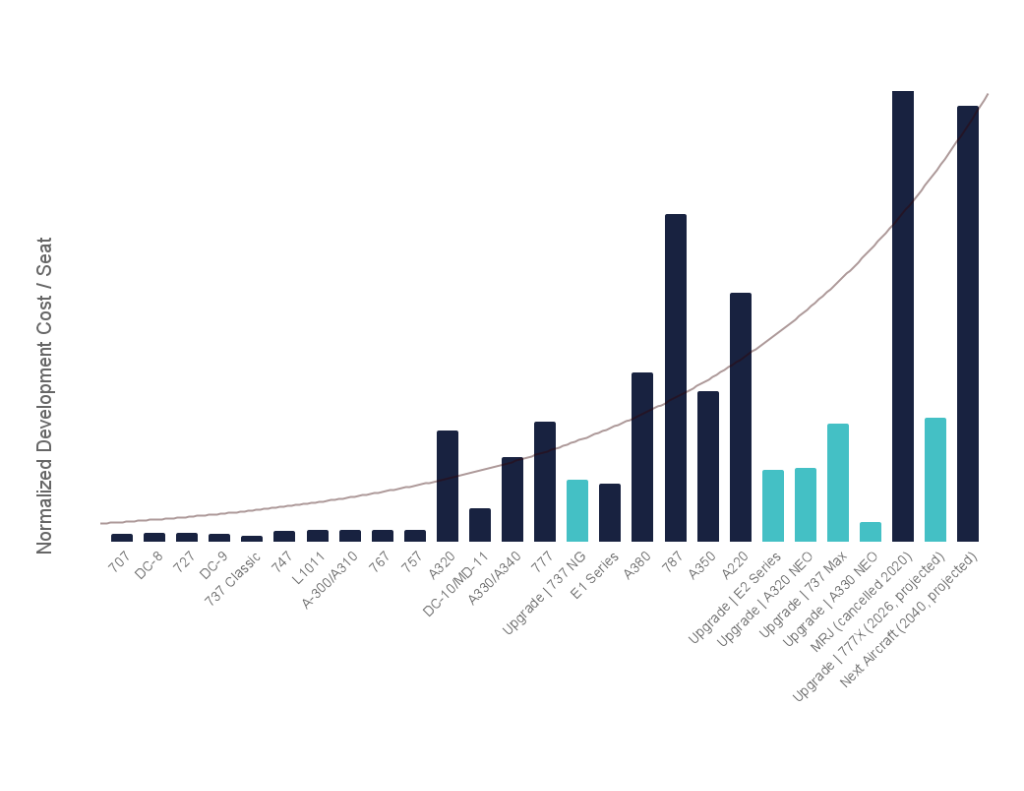

Worse, with each aircraft program the required capital has grown exponentially since the Boeing 707 in 1958 (see Figure 1), giving OEMs even less appetite to develop new aircraft.

Figure 1 | Development costs for all new (black) & derivative (teal) aircraft. Since the first Boeing 707, development costs for new aircraft have grown exponentially.

Source: Wikipedia, Author’s PhD dissertation.

Instead, they increasingly develop derivative aircraft: OEMs redesign an existing aircraft with improvements like a new, more efficient engine, and minor aerodynamic and structural refinements. It’s a decent, but uninspired alternative.

Compared to a new aircraft, the OEM saves appreciable time and capital by only redesigning a portion of the aircraft (see Figure 1), and gets to use its existing production facilities and supply base. In return, the airline customer receives an improved aircraft that integrates within the airline’s existing operations (e.g. crew training, maintenance, network optimization), and provides a good portion of the performance improvements of a new aircraft. It’s a relatively low risk and effective best “bang-for the buck” approach.

In 2024, almost 80% of all new aircraft deliveries to airlines were derivative aircraft (see Figure 2).

Figure 2 | Derivative aircraft deliveries as a percentage of total commercial aircraft deliveries. Derivative aircraft have become the market-leading solution. Aircraft-type names indicate the first delivery of that derivative aircraft.

Sources: Wikipedia, Aviation Weekly, Aviation International News, Flight Global, and Cirium.

However, airlines know that this low-risk approach is flawed.

No aircraft have ever been originally designed in anticipation of a derivative; they are designed to be replaced by new aircraft types.** This leaves derivative aircraft with two major handicaps.

First, there are physical limits on improvements to derivative aircraft. The 737 Max is a poignant reminder of pushing to and past these limits.

Second, the improvements on derivative aircraft usually cannot be upgrades to the existing in-service fleet. Improvement means waiting — often a decade or more — for the production line to build enough derivative aircraft to replace the fleet.

The net effect: improvements from derivative aircraft only barely offset other increases in cost, perpetuating the fleetwide efficiency plateau (Figure 3).

Figure 3 | Global Fleet Cost per Available Seat-Mile (CASM); lower values are better. The introduction of derivative aircraft has only perpetuated the fleetwide performance plateau.

Sources: “A better approach to airline costs”, McKinsey & Co, 2017, and IATA.

The only way to satisfy market demand for transformational performance of new aircraft while preserving the low financial risk of a derivative aircraft is an aircraft designed to continuously and rapidly improve: a modular aircraft.

A modular aircraft not only unlocks comprehensive improvements for derivative aircraft, but also unlocks deployment of those improvements as upgrades to the in-service fleet.

Modularity unlocks evolution.

No more physical limits. No more waiting decades. No more marginal improvements.

Modularity is the only economically viable and scalable solution, and we’re the ones making it happen.

Getting the First Aircraft to Market

Before we can upgrade our modular aircraft, we need to finish developing it. A modular aircraft lets us streamline development in many ways, but conceptually it looks like this.

Because traditional aircraft are not designed to change in-service, OEMs have to ensure that the design and any new technology are fully optimized at entry-into-service The result? Years and years of analysis, protracted development, and high capital costs. This is the biggest reason why development takes so long and costs so much.

A modular aircraft can enter service with a slightly sub-optimal design (from a performance standpoint only; safety by definition cannot be compromised) and mature off-the-shelf technology. The OEM can subsequently retrofit new technology, and continue to optimize performance. The OEM avoids protracted development and gets the aircraft into service far faster.

The future of commercial aviation will be defined by how we build as much as what we build.

A Once-in-a-Generation Opportunity

Even as air travel continues to grow, the world feels more physically disconnected than ever. We have to make air travel more accessible and sustainable for civilization to thrive.

There has never been a better time to do that.

The incumbents are uniquely vulnerable. They continue to kick the can down the road: Boeing, Airbus, and Embraer all delayed their next generation aircraft to 2040. The aircraft they do have — the newest designed almost 20 years ago — aren’t produced in high enough numbers; airlines need 30% more aircraft to meet demand.

The talent to do all of this is ready as well. A new generation of aerospace engineers armed with first-principles thinking and AI are eager to apply their skills. Meanwhile, the last generation of engineers to truly develop a completely new aircraft is about to retire. With incumbents waiting until 2040, they will miss the window to adequately train their workforce.

____

All of the ingredients are present: Engineering feasibility, business case, customer demand, incumbent inaction, talent availability, and societal impact. It is just a matter of execution.

That is why we’re building Aeris Evolution.

Because flying should feel like the future — not the past.

Designed to deliver. Engineered to evolve.

* For example, see Aviation Week’s candid opinion piece “Industry Must Make Developing a New Aircraft Affordable”, April 2024.

** When Airbus introduced the original A320 in 1988, it only used three digits for the serial numbers because they didn’t expect to sell more than 999 total aircraft before developing a new replacement aircraft. Now in 2025, Airbus has received more than 19,000 orders for the A320 and its derivative, the A320 NEO (New Engine Option).